Stock portfolio risk calculator

Well the SmartAsset investment calculator default is 4. This may seem low to you if youve read that the stock market averages much higher returns over the course of decades.

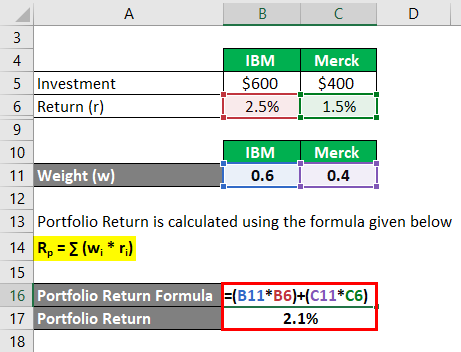

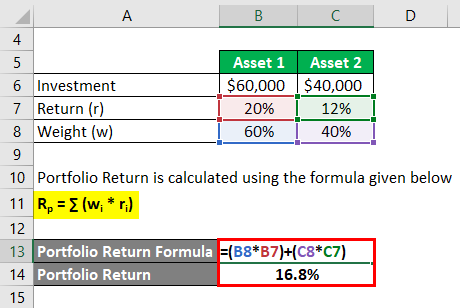

Portfolio Return Formula Calculator Examples With Excel Template

Interest Rate Parity IRP Calculator.

. Ad Learn More About American Funds Objective-Based Approach to Investing. They are designed to optimise the risk return relationship including currency considerations. Gordon Growth Model GGM Calculator.

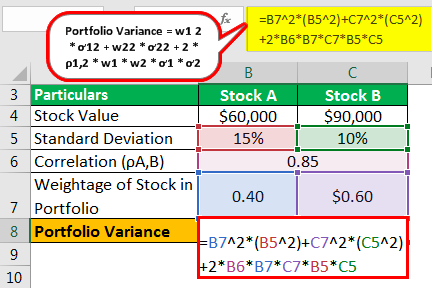

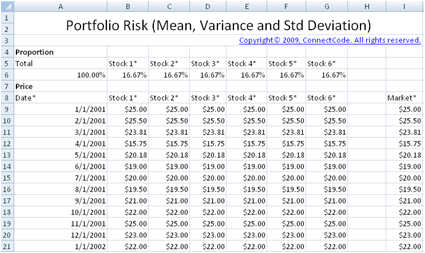

The variance of the return on stock ABC can be calculated using the below equation. Mean Variance Optimization Find the optimal risk adjusted portfolio that lies on the efficient. Ad Drill Down into an Individual Company S Sales and Ebitda over Time.

If you dont want to take any risk with your money you should probably look to put your money in cash however you need to be aware that there is limited chance of. Investors Business Daily often suggests a 7 or 8 automatic sell from your purchase price. Free Cash Flow to Firm FCFF Calculator.

Im looking for safety first. Ad Drill Down into an Individual Company S Sales and Ebitda over Time. The correlation coefficient is majorly used to determine the relationship between two assets and.

5 Estimate the value at risk VaR for the portfolio by subtracting the initial investment from the calculation in step 4. Ad The Most Powerful Platform to Generate Develop Research and Test Trading Strategies. Today most investors are wondering what they should do with their money in the wake of interest rates being cut inflation increasing the stock market crash and.

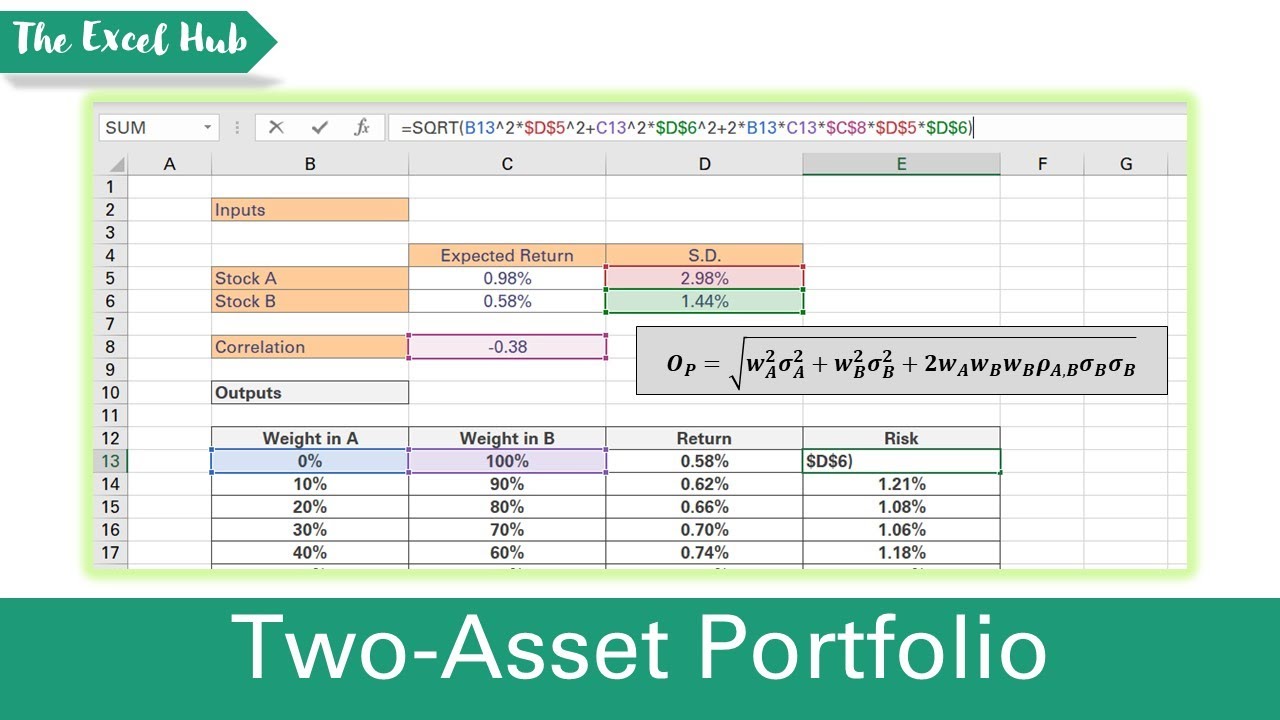

The formula for Portfolio Risk. Online Value At Risk Calculator for Portfolio. The calculator below provides key investment portfolio risk metrics.

Lets take a simple example. We Offer a Variety of Study Tips so You Can Focus on What Matters Most. Select only the assets you want to include in your portfolio.

Machine Learning and Genetic Programming to Automatically Generate New Automated Systems. Ad Learn How to Prepare for the CFA Level 1 Exam with Our Comprehensive Study Tips. See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing.

The calculator determines the IDIVs Dividend Cash Flow Exposure 1 relative to a similar sized investment in the underlying equity. This portfolio optimizer tool supports the following portfolio optimization strategies. InvestSpy provides you with free access to.

This calculator is a guide to help you design investment portfolios for five different levels of risk. Value At Risk is a standard. Finally we can calculate the VaR at our confidence interval var_1d1.

However when they all combine in form of a portfolio the risk is diversified and then different for a portfolio of the existing different stocks. The returns from the portfolio will simply be the weighted average of the returns from the two assets as shown below. The following table gives the computation of the.

Maintenance Capital Expenditure CapEx Calculator. Its an easy portfolio management tool for reducing risk. If you buy a stock at 50 your stop.

Risk or variance on a single stock. Specify StockETFCryptos quantities to instantly view Value at Risk VaR for portfolio using recent financial data. Risk contributions volatility beta value at risk VaR maximum drawdown correlation matrix and intra-portfolio correlation.

Risk contributions volatility beta value at risk VaR and maximum drawdown estimates help you understand your existing. The diversifiable risk cannot be minimized after adding 25 different stocks in a portfolio. RP w1R1 w2R2.

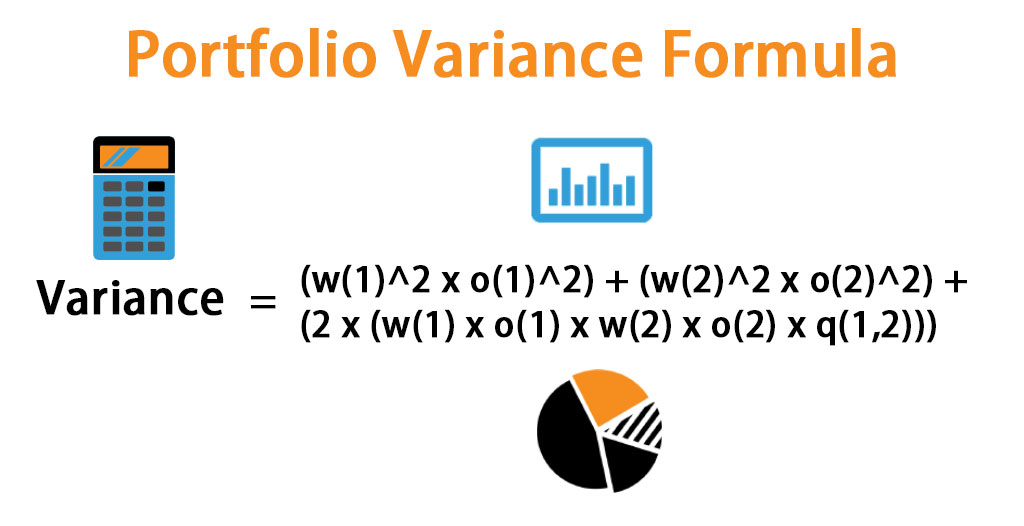

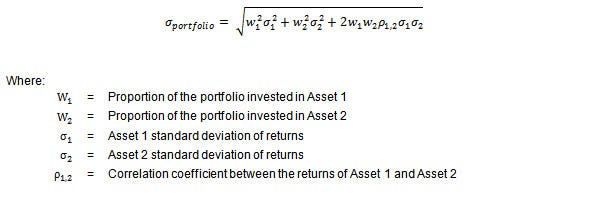

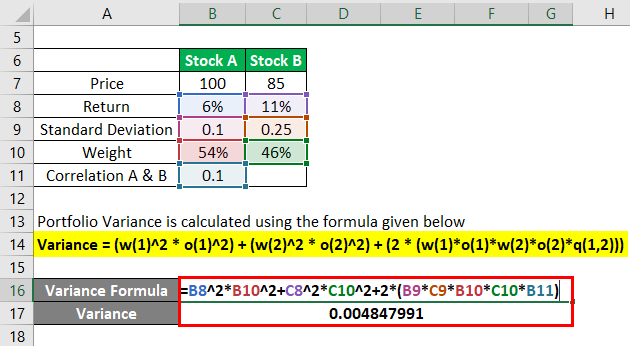

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Portfolio Variance Formula How To Calculate Portfolio Variance

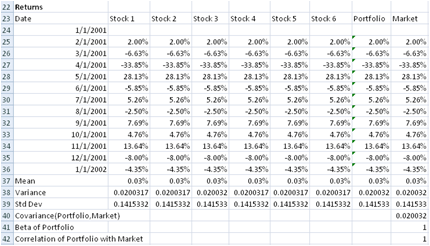

Assessing The Riskiness Of A Portfolio With Python By Bernard Brenyah Ds Biz Medium

Portfolio Return Formula Calculator Examples With Excel Template

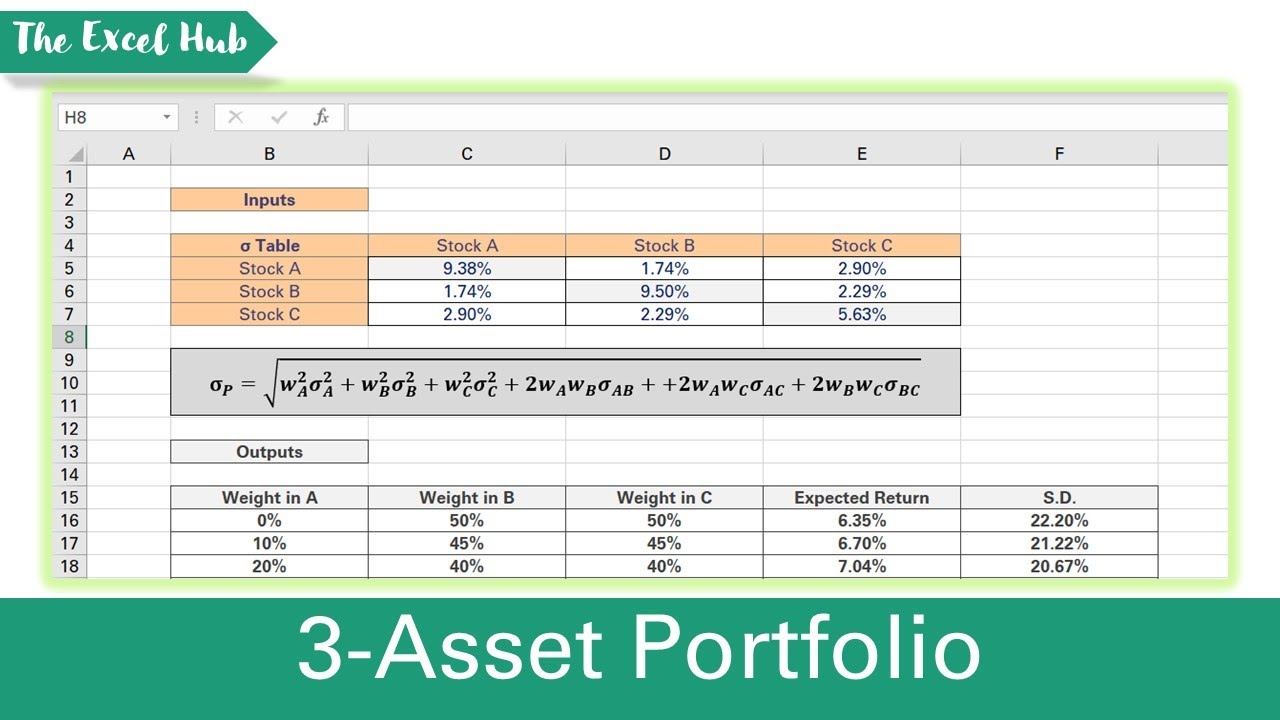

How To Easily Calculate Portfolio Variance For Multiple Securities In Excel Youtube

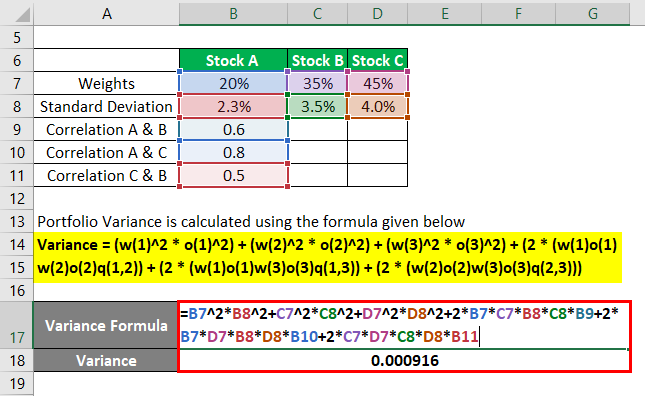

Portfolio Variance Formula How To Calculate Portfolio Variance

Free Modern Portfolio Risk Mean Variance Standard Deviation Covariance Beta And Correlation

Position Size Calculator Investment U Investment Tools

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

Calculate Risk And Return Of A 3 Asset Portfolio In Excel Expected Return And Standard Deviation Youtube

How To Calculate Var Finding Value At Risk In Excel

Portfolio Variance Formula How To Calculate Portfolio Variance

Portfolio Return Formula Calculator Examples With Excel Template

Free Modern Portfolio Risk Mean Variance Standard Deviation Covariance Beta And Correlation

Portfolio Analysis Calculating Risk And Returns Strategies And More

Calculate Risk And Return Of A Two Asset Portfolio In Excel Expected Return And Standard Deviation Youtube

Risk Part 4 Correlation Matrix Portfolio Variance Varsity By Zerodha